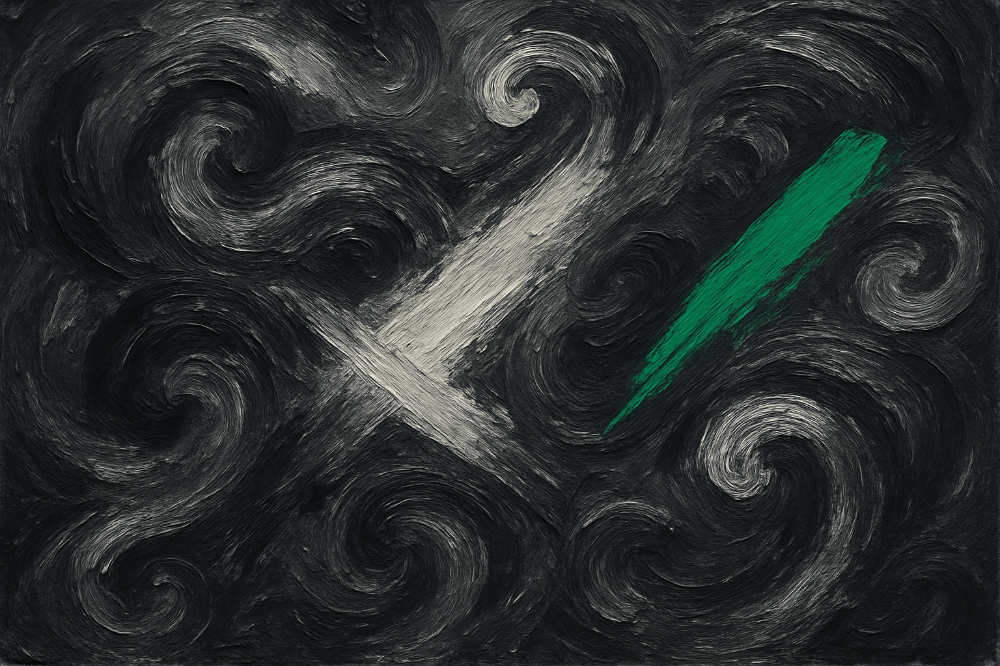

We like to believe that risk-taking is a rational game. That as traders, allocators, and investors you make decisions based on clear frameworks, stable preferences, and calculated edges.

But that’s not always the case. What if your biggest risk factor isn’t on the screen? But what is going inside?

Back in 2014, a groundbreaking study out of Cambridge Judge Business School, showed that chronic stress – in the form of elevated cortisol – caused dramatic reductions in financial risk appetite. We’re not talking about stress you feel in the heat of the moment. We’re talking about stress you barely register, but that’s silently re-wiring your risk tolerance.

What the study showed was that sustained cortisol levels, matching those of traders during volatile periods, led to a 44% drop in the “risk premium” participants were willing to tolerate.

In short: The longer you’re stressed, the more your body tells you: Don’t take the bet.

This shift isn’t about mindset, it’s about physiology.

Sustained levels of risk. Sustained levels of stress.

During the 2007/08 financial crisis, equity volatility in the U.S. spiked from around 12% to over 70%. As the months went on, there was also an increase in cash hoarding, frozen liquidity, and decision paralysis.

When cortisol rises, and stays elevated, it doesn’t just cloud your thinking. It narrows your willingness to tolerate downside risk. And in the markets, that often means missing upside opportunity.

Subterranean Shifts: What You Don’t Feel Can Hurt You?

As Dr. John Coates, a former Wall Street trader and co-author of the study, put it:

“It is frightening to realise that no one in the financial world – not the traders, not the risk managers, not the central bankers – knows that these subterranean shifts in risk appetite are taking place.”

Yet most investment teams and leadership still treat stress management like a personal responsibility or a side topic, something to deal with after the quarter’s over.

That’s like trying to recalibrate an aircraft after you’ve landed – assuming you make it that far.

So What Can Be Done?

You can’t eliminate stress from investing.

But you can build greater awareness of its physiological impacts and train for it.

This means cultivating emotional regulation, having predetermined ways of monitoring behavioural drift, and adopting coaching and reflective practice allowing things to come to the surface before it becomes costly.

In my work coaching investment professionals, from traders to CIOs, this is one of the hardest truths to teach:

You don’t always feel the moment when your body starts making decisions for you.

By the time you realise it, your thinking and decision making has already shifted.

Working with Risk?

I coach investors, traders, and fund managers navigating high-pressure decisions in volatile markets. If your edge depends on more than just insight.